- Financing solutions Connecting small business owners with financing solutions

- How it works Learn how we make the complex clear and the process seamless.

- About us We’re your dedicated small business financial partner.

For the last 15 years, SmartBiz has been serving small and medium-sized businesses across the United States. We’ve come to know small businesses quite well and, over the years, have evolved our business to meet their growing needs. We, too, have evolved: earlier this year, SmartBiz received regulatory approval to become a bank. Now, we can serve our existing customers and the broader national small business ecosystem even better.

Today, the business landscape is in a constant state of change. What was true six months ago may not be true six months from now.

That’s why we launched this survey for our customers. We wanted to ask the questions and hear directly from small business owners. How financially secure are they feeling? What support are they looking for? And how can we help them succeed?

Our ‘State of Small Business: Industry Pulse’ reflects that effort. It’s the beginning of an ongoing conversation and we are excited to share these insights broadly. Moving forward, we’re committed to using what we learn to shape more innovative solutions that truly meet the needs of small business owners today and in the future.

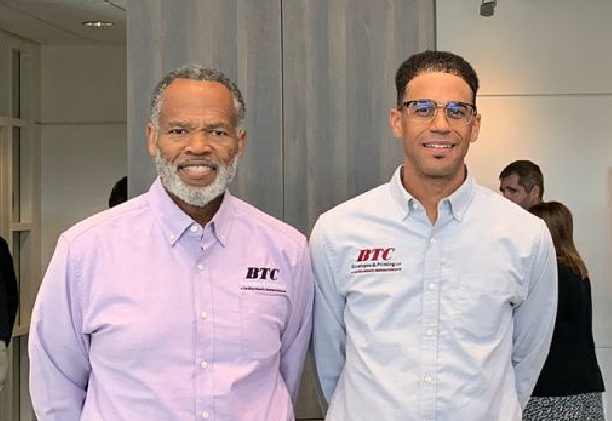

Evan Singer

CEO of SmartBiz Bank

Key Findings

- Most small businesses trust traditional banks the most as compared to other financial institutions, and around 40% have been with their primary business bank for more than 7+ years.

- Small business owners prioritize low fees and good rates when choosing a business bank - whether they are actively looking for funding or not.

- Small businesses are looking to keep things simple when it comes to business banking. Easy online and mobile banking is the most important feature for small business bank accounts, with low or no fees for ACH, wires, or transfers as the second most important feature.